Taxes

The most important tax for employees in Germany is the income tax, i.e. the tax on your wages. Every month, your employer will transfer the income tax as a "wage tax" to the tax office on behalf of you. You do not have to worry about anything at first. However, keep any tax documents in a safe place.

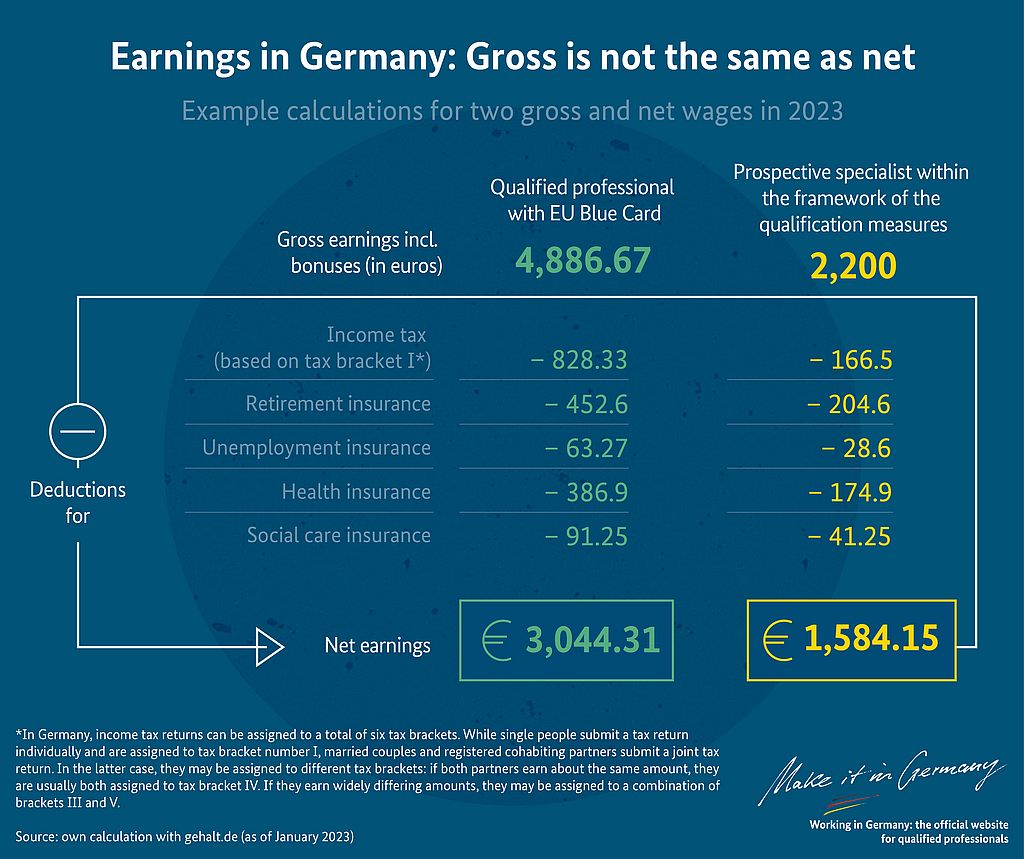

The amount of income tax you pay depends on your income itself. The higher your income, the higher the tax rate. It is also crucial for your tax bracket. Your tax bracket is influenced by factors like marriage or you having children, for example. If you are a member of the church, your employer also transfers the church tax to the tax office.

Social insurance

Germany has a well-developed system that provides people with financial security, for example in times of illness or unemployment.

In Germany, if you earn a sum of money above a certain limit, you are subject to social security contributions. This means that you must be a member of certain insurance schemes and pay contributions to them automatically. These include the following types of insurance:

- Statutory health insurance: it pays for doctor's visits and many pharmaceutical drugs and therapeutic measures.

- Statutory nursing care insurance: it provides basic income support in case of being permanently dependent on care due to illness. Elderly people are most commonly affected.

- Statutory pension insurance: it allows employees a pension after they have retired. The amount is mainly determined by your former income and the number of years you have worked in Germany.

- Statutory accident insurance: it covers the costs of medical treatment and reintegration into working life after a workplace accident or in case of occupational illness.

- Statutory unemployment insurance: it pays unemployed people an income for a certain period of time if certain criteria are met. As a rule, you must have been insured for at least one year during the last two years and you have to be in the process of looking for a job again.

You pay a fixed percentage of your salary for social security membership. Your employer pays a fixed percentage as well. The money is paid directly from your gross income to the insurance company; you do not have to transfer any contributions. As an employee, you are automatically a member of the pension, long-term care, accident and unemployment insurance schemes. There are no private providers, except for health insurance.

As an employee, you will be sent a social security card with a social security number. Please give this number to your employer. Keep the social security card in a safe place, as you will need the number from time to time; it will remain the same, even if you change your employer. If you lose your social security card, you can request a replacement from the German Pension Insurance (Deutsche Rentenversicherung).

Tax return

After the end of a calendar year, you can have the state check whether you have paid too much income tax. To do so, you submit your income tax return to the tax office and state how much you earned last year and how much tax your employer transferred to the tax office on your behalf.

In some cases, the tax return is compulsory, for example if you work for multiple employers. Most of the time, however, it is voluntary. Since most people get money back from the state, it is worth filing a tax return in many cases even if it is not compulsory.

It is possible to do the tax return yourself. To do so, use the forms provided by the tax office or the ELSTER programme. There are also apps for your smartphone and computer software that can help you out. You could contact an income tax assistance association or hire a tax consultant as well.